It’s tax season in Texas. Here are the important dates for the 2018 tax year that every homeowner needs to know. If you need help paying your Texas property taxes, contact Home Tax Solutions to learn more about a property tax loan.

January 31st

This is the last day you may pay your Texas property taxes before delinquency. The first payment for quarter payment plans, over-65 and disability homestead accounts is also due no later than January 31st.

February 1st

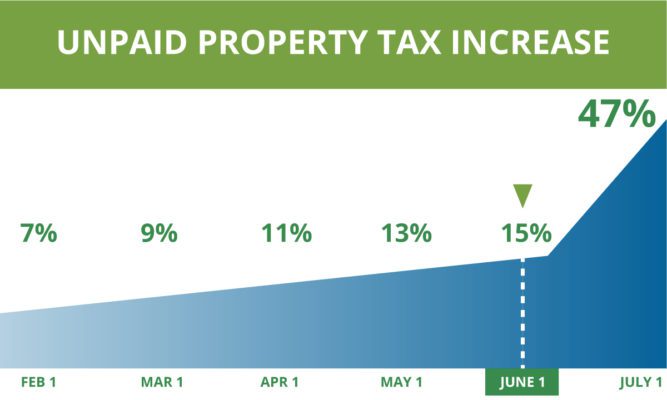

This is the day that penalty charges will start to accrue on unpaid taxes from the previous year. Penalty fees begin at 6% and increase monthly to a maximum of 12% by July. Interest begins to accrue at the rate of 1% per month until the delinquent amount is paid in full.

March 31st

This is the final date to make the second payment on any quarter payment plan. It is also the last day to pay business personal property accounts without receiving a collection penalty on top of your late penalty fees and interest charges. An additional collection penalty may be charged on personal property payments that are delinquent on April 1st.

April 30th

This is the last day you can file an exemption application at your County Appraisal District.

May 31st

This is the last day to make your third payment on quarter payment plans. It is also the last day for the current year that you may file a protest with the County Appraisal District.

June 30th

This is the last day to make your second payment on the half payment option.

July 1st

All delinquent accounts for the current year will be handed over to tax attorneys for collection. A costly penalty fee of up to 20% of the unpaid balance will be attached to the already accumulated penalties and interest.

July 31st

This is the last day to make your final payment on a quarter payment plan.*

October 1st

The current collection period will start on this date, and tax bills are mailed out to Texas property and business owners.

November 30th

This is the last day to make the first payment on the half payment option.*

Contact Us to Learn More

If you need help from a property tax lender, now is the time to call us. With a loan from Home Tax Solutions, you’ll have no payment for 12 months, and you’ll escape the expensive penalty fees and collection costs mentioned above.*Note: Check with your local tax office for current dates.