Can You Get a Property Tax Payment Plan in Texas?

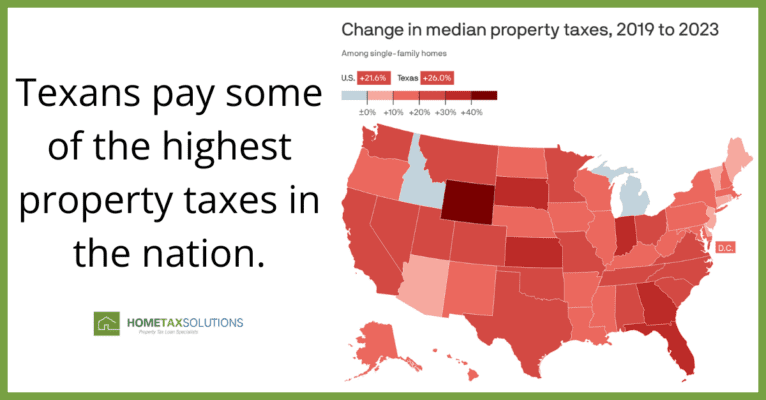

Navigating the complexities of property tax loan payments in Texas can be daunting for many homeowners. With the burden of tax bills looming large, you may find yourself wondering: Can you set up a payment plan for property taxes in Texas? The answer is a resounding yes, and Home Tax Solutions is here to walk […]

Read More