Frequently Asked Questions

Home Tax Solutions offers homeowners a property tax loan that makes paying off their delinquent property taxes easy and affordable. If you have any questions about the process, including how it works, read the answers to the most commonly asked questions about property tax loans below. If there are additional questions we have not sufficiently answered, please call us at 800-688-7306 or 214-420-1814. We’d be happy to help.

-

Is There An Application Fee?

No. An application fee is not a part of our process.

-

What Do I Need To Close My Loan With Home Tax Solutions?

To apply for a tax loan, you should have the following documents:

- Recent Mortgage Statement

- Proof of Income (paystubs, etc.)

-

How Are The Monthly Payments Set Up?

You will be set up on automatic withdrawal on the first of every month for your monthly loan payments.

-

What Happens If I Miss A Payment?

It is possible that a foreclosure could be initiated if your loan is delinquent. However, it is not our intention to seize your property. We work with you to avoid foreclosure. We have never foreclosed on a property.

-

Is It Possible To Prepay My Property Tax Loan?

Sure. You can prepay your property tax loan at any time with no fees or penalties.

-

Is It Possible To Get A Loan For Multiple Years Of Overdue Taxes?

Yes. We would be happy to pay off multiple years of backed property taxes. You can also finance your future property taxes by rolling them into the loan if you need help in the future.

-

How Long Does It Take To Close A Loan and Pay Off the County?

It generally takes 3 business days from the start of the application to the closing of the property tax loan. Once the loan is closed, Home Tax Solutions will pay off the taxing authority in full to stop the fees and penalties being accrued against you

-

What If I Have Bad Credit? Will It Affect My Ability To Get A Loan?

Bad Credit History will not affect your loan approval. Home Tax Solutions will not pull any credit reports on individuals.

-

How Can I Apply For A Loan?

You may apply online or via phone. Your online application and phone consultation is confidential, and there is no obligation. Apply online or call 800-688-7306 or 214-613-2387

-

I Have Multiple Properties. Is It Possible To Get Loans For All Of The Properties?

Yes. There is no limit to the amount of properties we provide loans for. However, we create separate loans for each property.

-

What Is The Annual Interest Rate On A Property Tax Loan?

Our current interest rates vary depending on loan terms, loan amount and property type. Call us for an exact quote.

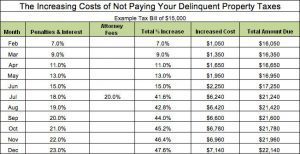

- What Is The County Charging Me For My Overdue Property Taxes?

-

Can I Lose My Home Because Of Delinquent Property Taxes?

Yes. It is possible to lose your home to foreclosure from your taxing authority. The taxing authority has the authority to enforce a foreclosure due to unpaid property taxes. The longer your taxes go unpaid, the more likely it is that the taxing authority will foreclose on your property.