Property Tax Penalties & Interest

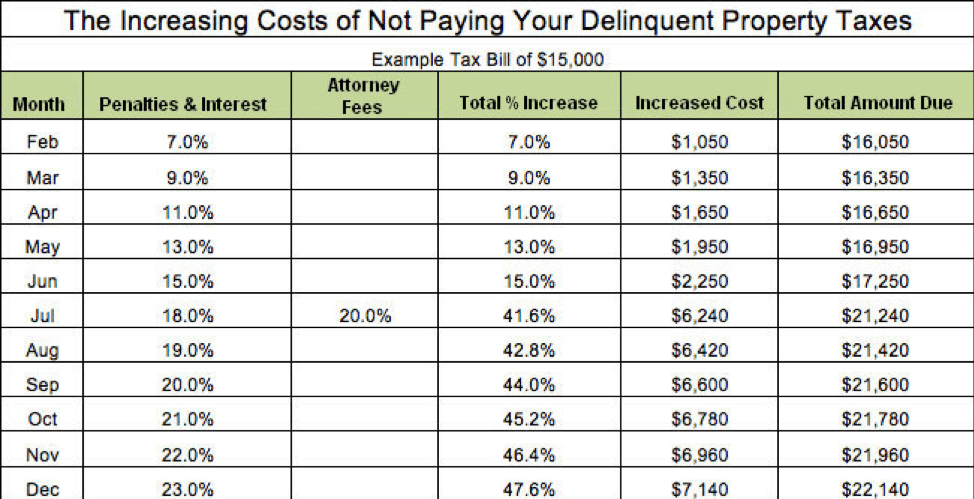

Your property taxes must be post marked by January 31st to avoid tax penalties. As of February 1st, your tax bill will accrue a 6% penalty. Each month, the penalty will increase by 1% until it reaches the maximum of 12% on July 1st. Additionally, delinquent property taxes may accrue an additional penalty up to 20% added as of July 1st. This delinquency penalty is 20% of all property taxes, penalties, and interest accrued to that date, and it is used to cover legal and court fees when property taxes are handed over to attorneys for collection.

In addition to the penalties that begin to accrue as of February 1st, a 1% interest charge is also added, making the total property tax increase 7% on February 1st. As with the penalty increase, the interest rate also increases 1% each month. As of July 1st, this is an additional 6% interest. That means that your total penalty and interest rate before legal action is taken due to delinquency is nearly 18% of the total.

Delinquent Property Taxes

If your property taxes and all penalties and interest aren’t paid by June 31st, the bill is considered delinquent as of July 1st, and the taxing unit may hire private attorneys to collect on the account. These attorneys may charge an additional penalty up to 20% to cover their legal fees. The last resort for the local tax collectors is bringing a legal suit through these attorneys. If you’re unwilling or unable to pay delinquent taxes after July 1st, you increase your risk to be sued for repayment.

Tax Liens

On January 1st the state attaches a sovereign lien on each taxable parcel of land in the state. This lien is not due and payable until Jan 31st of the following year. This gives local taxing units the ability to foreclose and seize these properties if delinquent property taxes remain unpaid. Even if you sell your property, the delinquent tax lien is still in place and the property can be seized unless the buyer or seller pays the entirety of delinquent property taxes.

Let the Home Tax Solutions Team Help

Instead of accruing these hefty penalties and interest and risk legal action or foreclosure, let the Home Tax Solutions team help. Our low interest loans allow you to spread the cost of property taxes through the year without the hefty fees and penalties associated with delinquent taxes.