If you’re considering a property tax loan to cover your annual bill, the Home Tax Solutions team is here to answer your questions and talk to you about your options. Not sure that a property tax loan is right for you? Read this blog to review our top five reasons to get a property tax loan, and don’t hesitate to get in touch with the knowledgeable team members in one of our five office locations across the state of Texas to learn more.

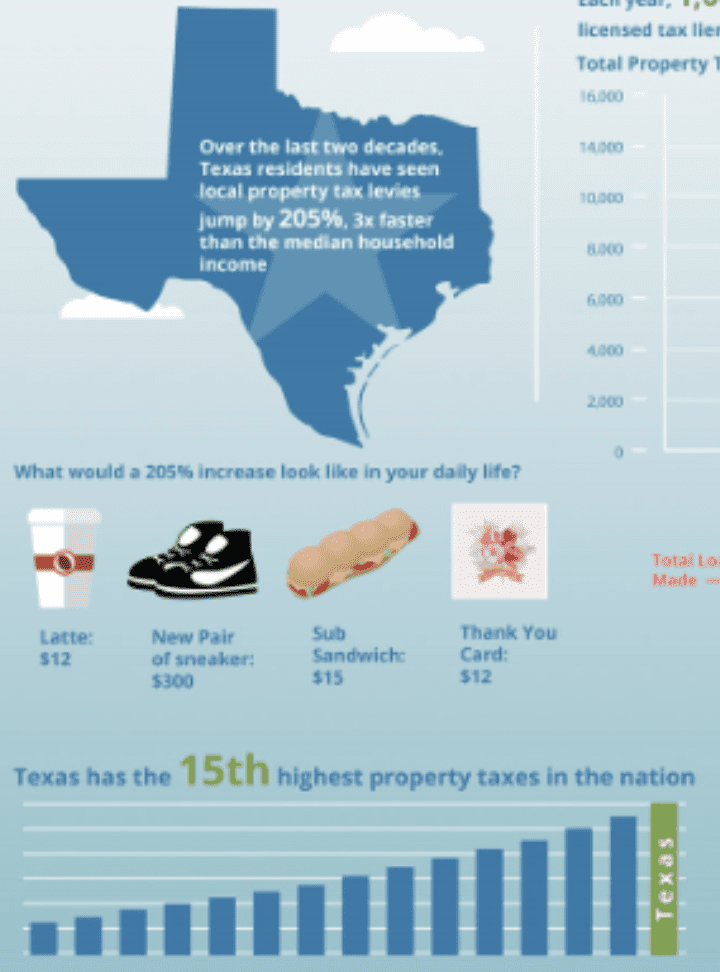

1. Texas Property Taxes are on the Rise

Over the last 20 years, Texas property taxes have risen exponentially. Research indicates that annual property tax rates have increased 205% in two decades, and Texas has the 15th highest property taxes in the U.S. With home tax rates increasing as much as 3xs as fast as income, it’s no wonder many Texas homeowners are struggling to cover the cost of their annual property tax bill. Knowledgeable professionals predict that home tax rates in the state of Texas will continue to rise, so getting a handle on any delinquent property taxes now is essential. A property tax loan from Home Tax Solutions can help you manage any outstanding property tax bills and budget for future property tax bills.

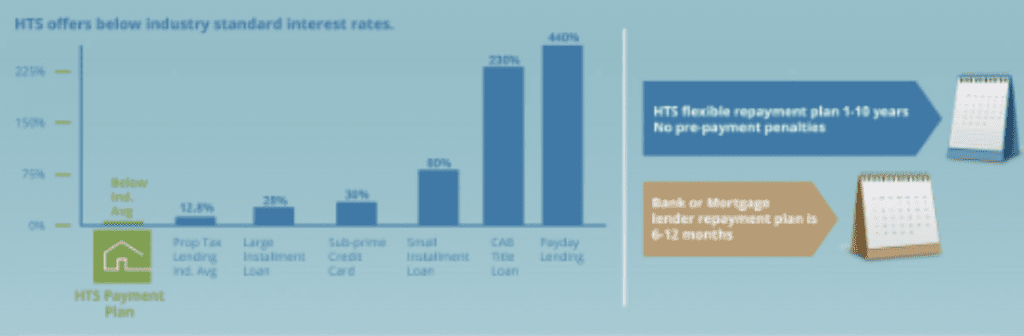

2. Below Industry Standard Interest Rates & Better Repayment Terms

If you decide to move forward with a property tax loan, we hope you’ll choose to work with Home Tax Solutions. Our manageable payment terms and reputable business practices have made us one of the most trusted home tax loan providers in Texas. Compared with traditional bank loans, a property tax loan gives you a longer amount of time to repay the loan. In most cases, bank loans for property taxes must be repaid in six to twelve months. Our home tax loans have repayment terms of between one and ten years with no prepayment penalties. You may also consider paying your property tax bill with a credit card, but the interest rates on credit cards are significantly higher than those associated with our property tax loans.

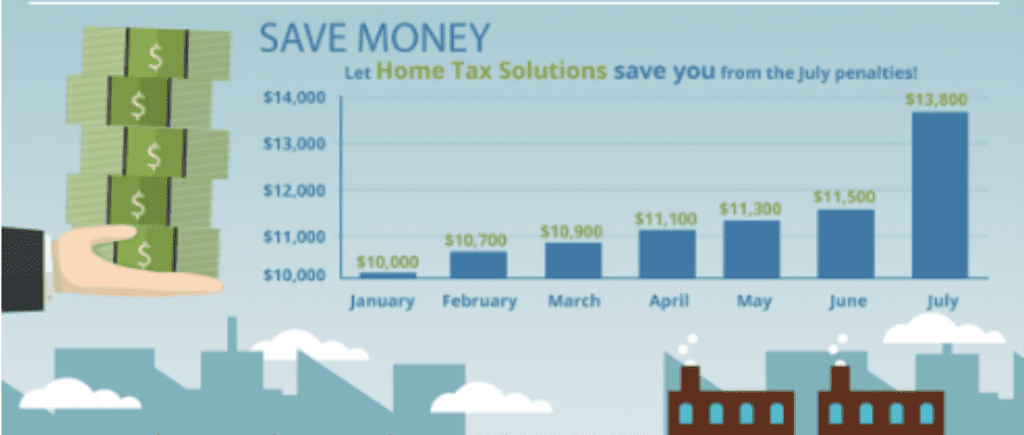

3. Save Money Now & Relieve Financial Stress

Our team members understand that you can’t always plan for or avoid financial stresses that arise. If the unexpected has made it impossible or difficult for you to cover the cost of your annual property taxes, a property tax loan can help. If you stay delinquent with the county, the fees, interest, and penalties will add up fast, and you’re at risk of having your home foreclosed on. If you’re struggling right now, our repayment plans with an option to defer payment for up to a year give you an opportunity to get back on your feet without incurring high late payment penalties.

4. We Make Applying for & Receiving Property Tax Loans Simple

The last thing you need when you’re dealing with financial struggles is one more thing to worry about. That’s why the Home Tax Solutions team makes the property tax loan process simple. When you work with us, you can expect:

- A streamlined process with a 10 minute phone call or online application

- No credit checks

- No cash down and nothing due at signing

- Your taxes are paid to the county within 24 hours after signing

- No early payment penalties

5. End the Stress Associated with Delinquent Property Taxes

Worrying about a delinquent payment and potential home foreclosure can cause high levels of unnecessary stress. Relive that unnecessary stress and anxiety now. Let the Home Tax Solutions team get your delinquent property taxes paid within just a few days.

Get Started with Home Tax Solutions Today

When you’re ready to get started with a Texas property tax loan, the Home Tax Solutions team is here to help. Simply take a few moments to get the process started by completing our online application.