Property taxes can be a thorn in the side for many homeowners, but these monies help Texas government provide essential services for communities across Texas. Property taxes are local taxes, and they provide the largest source of money to cover the costs of schools, hospitals, police and fire protection, and road services and supplies (roughly $200 million in cash flow revenue for various taxing jurisdictions across the state). Rather than wait and collect a portion over the course of several years, Texas communities see this money right away to cover the costs associated with city and county services and avoid the added burden and cost of tax collection management.

Texas Property Tax

According to the Texas Comptroller of Public Accounts, “Property taxes are local taxes that provide the largest source of money local governments use to pay for schools, streets, roads, police, fire protection and many other services. Texas law establishes the process followed by local officials in determining the value for property, ensuring that values are equal and uniform, setting tax rates and collecting taxes.” To accomplish this, the county tax collector works on behalf of various city and county entities to collect taxes. The tax rate for each entity determines your property taxes. The Central Appraisal District for the county holds a record of your property and the entities that can tax your property.

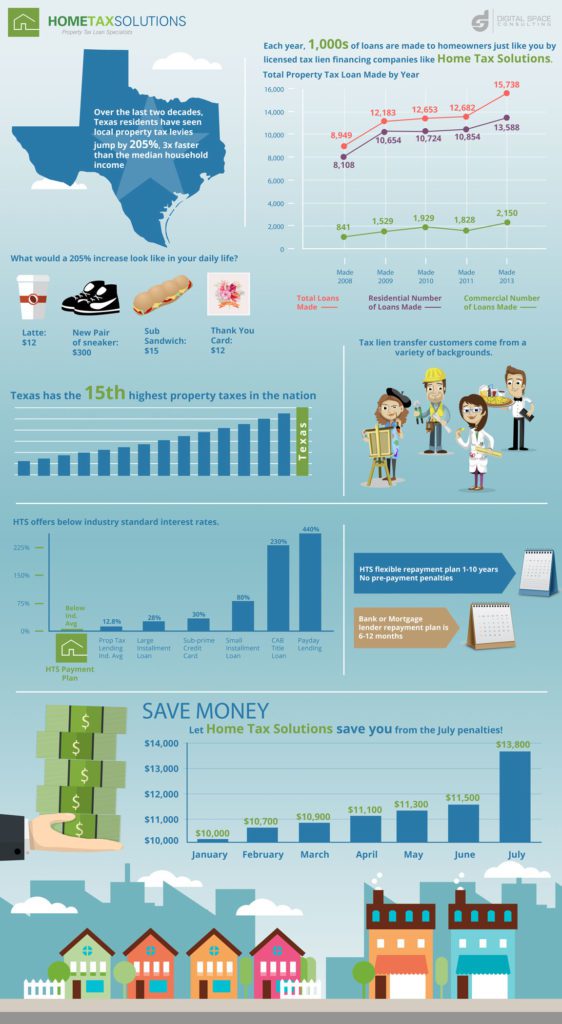

Property taxes are sent in October and are due the following January 31. If left unpaid, the property tax bill becomes past due on February 1, and penalties, interest, and other fees can accrue. Property owners have seen a huge jump in property tax levels over the last two decades. This exceeds the average household income.

Why You Need Property Tax Loans

A property tax loan from Home Tax Solutions can help save you money, bring your property tax payment current, and avoid the added cost of nonpayment. Get in touch with our team today and learn how you can benefit from a property tax loan.