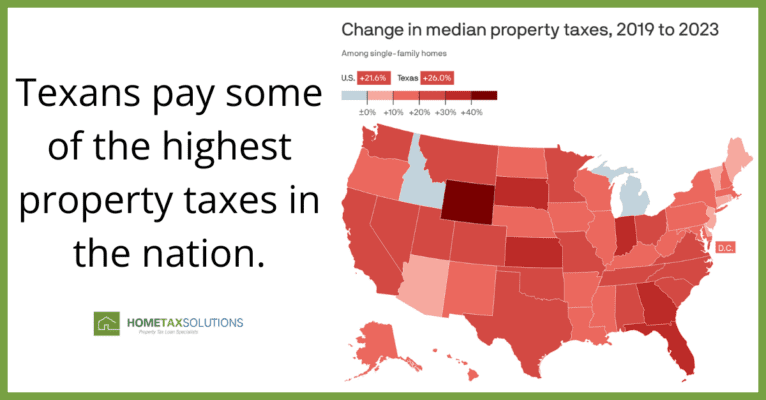

Recent data highlights a concerning trend for Texas homeowners: between 2019 and 2023, median property taxes surged by a significant 26%, despite concerted efforts by local and state authorities to alleviate the impact. This revelation coincides with the commencement of the protest process for properties within the Dallas Central Appraisal District, offering homeowners until May 15 to contest their property valuations.

Grasping the Larger Picture

Across the nation, the landscape of homeownership is undergoing profound shifts, fueled in part by the rapid escalation in home prices driven by the pandemic. Texas, distinguished by its lack of a state income tax, bears one of the heaviest property tax burdens in the country. These taxes, contingent on a property’s assessed value and the prevailing local tax rate, serve as a cornerstone for funding critical public services such as education, infrastructure, and emergency response.

National Trends and Texan Realities

The nationwide surge in property tax bills mirrors the experience in Texas, with median property taxes on U.S. single-family homes soaring from $2,367 in 2019 to $2,877 in 2023, as per CoreLogic data. Correspondingly, Texan households witnessed a substantial hike, with median property tax bills ascending from $3,900 to $4,916 during the same period.

Local Dynamics

Taking a closer look at individual counties reveals the intricate interplay of factors. Denton County experienced a significant uptick, with the average taxable value of homes rising from roughly $402,000 in 2022 to approximately $449,000. Likewise, Collin County saw a substantial increase, with the average market value of homes surging from around $513,000 to $584,000 between 2022 and 2023. These localized fluctuations shed light on the wider array of challenges facing homeowners across the state.

Navigating the Path to Relief

Despite the significant strides made, such as the historic property tax cut approved by Texas voters in November, addressing the root causes necessitates a multifaceted approach. Homeowners are encouraged to actively participate in the protest process to ensure that property assessments align with market realities, offering a potential avenue for relief.

How Home Tax Solutions Can Provide Assistance

During times of escalating property taxes, homeowners require steadfast support. Home Tax Solutions steps in with tailored property tax loans designed to alleviate the strain of sudden tax spikes. By extending flexible financing options, Home Tax Solutions empowers homeowners to navigate their tax obligations while preserving financial stability and peace of mind.

As Texans navigate the challenge of burgeoning property taxes, a comprehensive understanding of the prevailing trends and available solutions becomes imperative. By engaging in the protest process, advocating for policy reforms, and fostering community dialogue, homeowners can chart a course towards a more equitable property tax landscape. Through collaborative efforts spanning local, state, and national domains, Texas can endeavor to lighten the financial burden on households and pave the way for a sustainable future in homeownership, bolstered by the support of Home Tax Solutions.