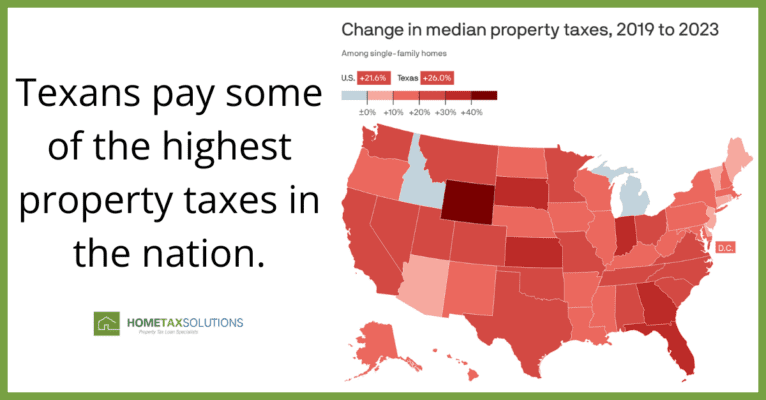

Assessing the Impact: Have Texas Republicans Successfully Lowered Property Taxes?

For the past five years, Texas Republicans have been on a mission to tackle the state’s soaring property taxes. With billions of dollars invested and significant legislative efforts, the aim was clear: provide relief to homeowners burdened by escalating property tax bills. But has this crusade borne fruit? Let’s delve into the data and stories […]

Read More