At Home Tax Solutions, our knowledgeable team offers affordable property tax loans to help homeowners in all 254 Texas counties fit their home tax costs into their annual budgets. If you live in Fort Worth or one of the neighboring Dallas-Fort Worth Metroplex communities, we can help with your current or delinquent property tax bills, so don’t hesitate to reach out or get started with an online application form today. This short application form is easily completed in just a few moments, but it gives our knowledgeable experts the information they need to get to work helping you with your property tax bill right away. We look forward to hearing from you.

The Home Tax Solutions Loan Process in Fort Worth

If you own a home in the city of Fort Worth, we can offer property tax loan services out of our Dallas headquarters located at 4849 Greenville Avenue, Suite 1620. This location provides home tax loan services for residents of Fort Worth, Tarrant County, and all of the Dallas-Fort Worth Metroplex. Reach out to our team members by phone at (214) 420-1814 to get started.

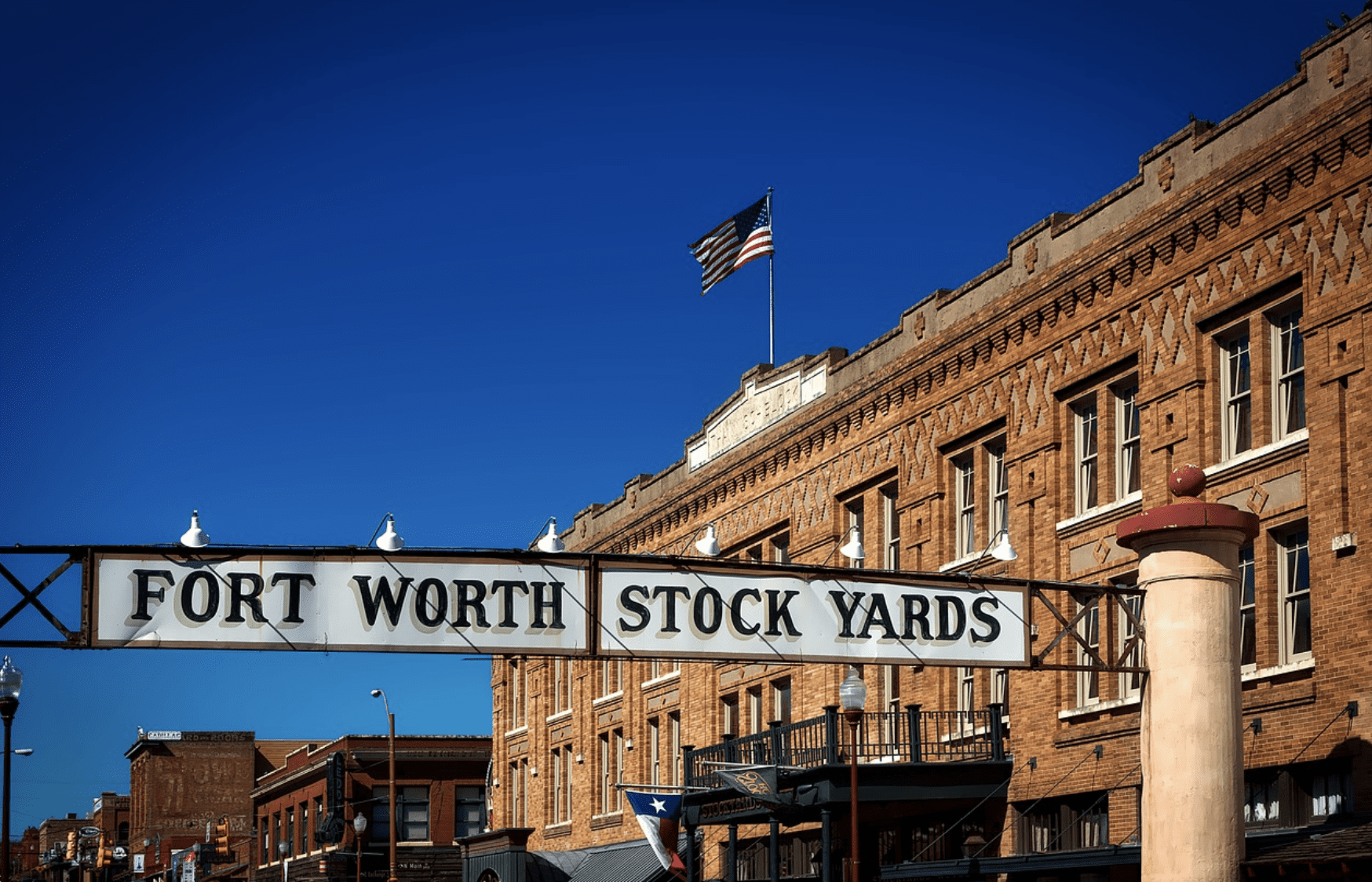

About Fort Worth

Fort Worth is the 13th most-populous city in the US and the 5th largest in the state of Texas with a population of about 910,000. The city of Fort Worth was established in 1849 as a military outpost. It’s named for William J. Worth, a military officer in the War of 1812, Second Seminole War, and Mexican-American War. While a military history is infused in its name, Fort Worth quickly became well known as a trade center for longhorn cattle, and the city embraces its western culture. Today, Fort Worth is also a thriving art and culture center with numerous colleges and universities, museums, and annual events like the Van Cliburn International Piano Competition. The average property tax rate in Fort Worth is 2.77%, but some areas can be even higher, meaning Fort Worth property taxes are among the highest in the state and the U.S.

City of Fort Worth Resources

If you want to find out more about property taxes and other tax and residency information for the city of Fort Worth, we invite you to explore some of the following resources:

City of Fort Worth, Texas Homepage

This government site connects city of Fort Worth residents, homeowners, and visitors to important information and resources they may need, including pertinent tax information.

Office of the City of Fort Worth District Clerk

The City of Fort Worth District Clerk helps residents find information on costs and fees, government agencies, records and documents, and forms that may be necessary to learn more about your property taxes.

City of Fort Worth Appraisal District

The City of Fort Worth Appraisal District website gives residents access to resources they may need for property valuation, disaster appraisals, and other solutions.

City of Fort Worth Tax Office

If you have questions about your property taxes, fees, or deadlines, the City of Fort Worth Tax Office will give you access to the information you need.

Office of the City of Fort Worth District Attorney

The City of Fort Worth District Attorney’s office may have relevant information about changes in tax law, public service announcements, and other information you may need about ever-changing property taxes.

Fort Worth Counties

The majority of the city of Fort Worth falls within Tarrant County, but portions of the city also fall in Denton, Parker, and Wise Counties.