Your Home May Be Subject To Foreclosure

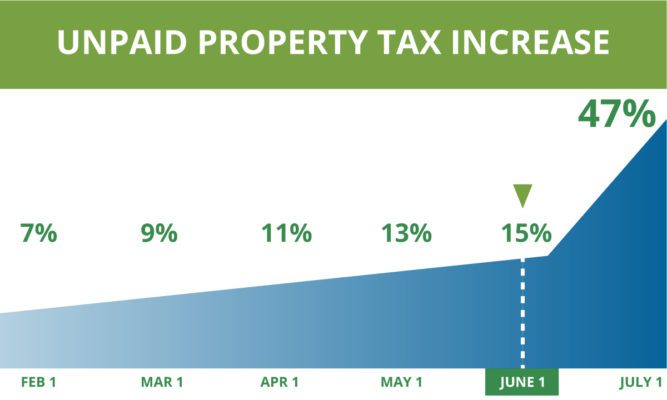

What happens to my home if I never pay the property tax in Texas? If the June 30th deadline passes and your property taxes are not fully paid off, including any accrued penalties or fees, it could result in a tax foreclosure of your property. In a scenario where the deadline may have passed, you […]

Read More