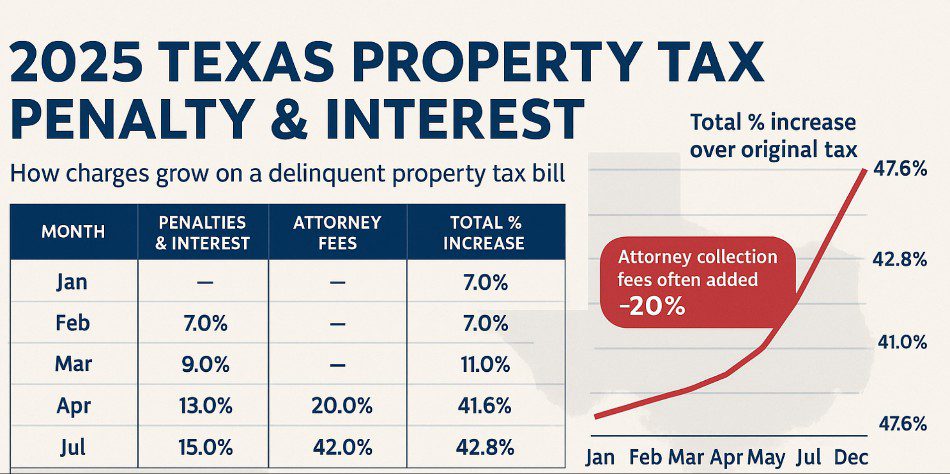

Texas property tax penalties and interest increase every month once taxes become delinquent. By summer, penalties can reach up to 20 percent, and attorney fees often add another 20 percent. By December, your balance can be almost 47% higher than your original tax amount.

Falling behind on your property taxes is stressful. In Texas, it gets expensive very quickly. The moment your taxes become late, counties start adding penalties, interest, and fees that grow each month. By summertime, many homeowners are surprised to see their bill jump by thousands of dollars. By December, you could owe almost 50% more than when you started.

You’re not alone in this. Every year, thousands of Texans run into the same problem. The good news is that there are clear numbers that show exactly how penalties and interest build up, and there are ways to stop them.

How the Property Tax Penalties Add Up

- February 1: Your taxes are officially delinquent and a 7% penalty is added.

- Each month after: Another 1–2% is added to your balance.

- July: Attorney collection fees often kick in, usually around 20% of your base tax bill. This is the steepest jump of the year.

- December: By year’s end, your balance could be about 47.6% higher than your original tax amount.

Note: Attorney collection fees are typically 20% of your base tax bill, though counties can vary. For example, Travis County does not apply attorney fees until legal action begins.

2025 Texas Property Tax Penalty & Interest Chart

| Month | Penalties & Interest | Attorney Fees | Total % Increase |

|---|---|---|---|

| Jan | — | — | — |

| Feb | 7.0% | — | 7.0% |

| Mar | 9.0% | — | 9.0% |

| Apr | 11.0% | — | 11.0% |

| May | 13.0% | — | 13.0% |

| Jun | 15.0% | — | 15.0% |

| Jul | 18.0% | *20.0% | 41.6% |

| Aug | 19.0% | *20.0% | 42.8% |

| Sep | 20.0% | *20.0% | 44.0% |

| Oct | 21.0% | *20.0% | 45.2% |

| Nov | 22.0% | *20.0% | 46.4% |

| Dec | 23.0% | *20.0% | 47.6% |

*Attorney collection fees are usually calculated on the base tax amount. Always confirm specifics with your county tax office.

Why It Matters

- Late fees grow fast — a $5,000 bill in February can approach $7,500 by December.

- Attorney fees can spike your balance overnight once they’re added.

- Foreclosure risk is real — counties can foreclose to collect unpaid taxes.

- The earlier you act, the less you’ll owe and the easier it is to get back on track.

How a Property Tax Loan Can Help

- We pay your delinquent taxes directly to the county, stopping property tax penalties and interest immediately.

- No cash due at closing and no credit check required.

- Flexible repayment options — you can delay your first payment for up to 12 months.

- Licensed loan officers build a plan around your budget so you can keep your home and peace of mind.

Get Help With Property Taxes Now | Talk to a Licensed Loan Officer

FAQs About Property Tax Penalty & Interest Chart

How can I stop Texas property tax penalties from adding up?

Penalties and interest increase every month until the county receives full payment. A property tax loan pays your balance directly to the county, which stops new penalties and interest immediately.

Do counties offer property tax payment plans?

Some Texas counties offer short-term plans, but they often require a large upfront payment and usually don’t stop interest from accruing. A property tax loan spreads payments over time with lower monthly installments and halts additional penalties.

Will a property tax loan affect my credit?

At Home Tax Solutions, we do not pull your individual credit report. There’s no hard inquiry, and your credit score is not used to determine approval.